Alternative Credit Scores – Own Your Financial Future – with AxcessAltData

Ever since the mid-20th century, personal credit scores and reports have been the gold standard for lenders to evaluate the creditworthiness of individuals when applying for loans or any type of credit product. However, lenders have seen that with a high default rate, including the biggest financial crash of 2008–09 due to predatory lending, credit scores alone don’t paint a clear picture of consumer’s financial behavior and credit worthiness. Lenders don’t consider factors that aren’t traditional, like income or spending habits.

Incorporating non-traditional data, such as on-time Rent payment for renters, bill payments (utilities, insurance, etc), alternative loan types (buy-now-pay-letter BNPL, payday advance), to name few, can actually reveal a more complete holistic picture of a consumer’s financial behaviors and creditworthiness. This “alternative data,” credit scores, in addition to traditional credit scores, ultimately give a complete picture that can increase individuals access to lower interest rates. Alternative Credit Scores can help 45 million consumers who may be denied access to traditional credit because they do not have credit records that can be scored. 26 million are credit-invisible, while 19 million have “thin file” or “stale file”.

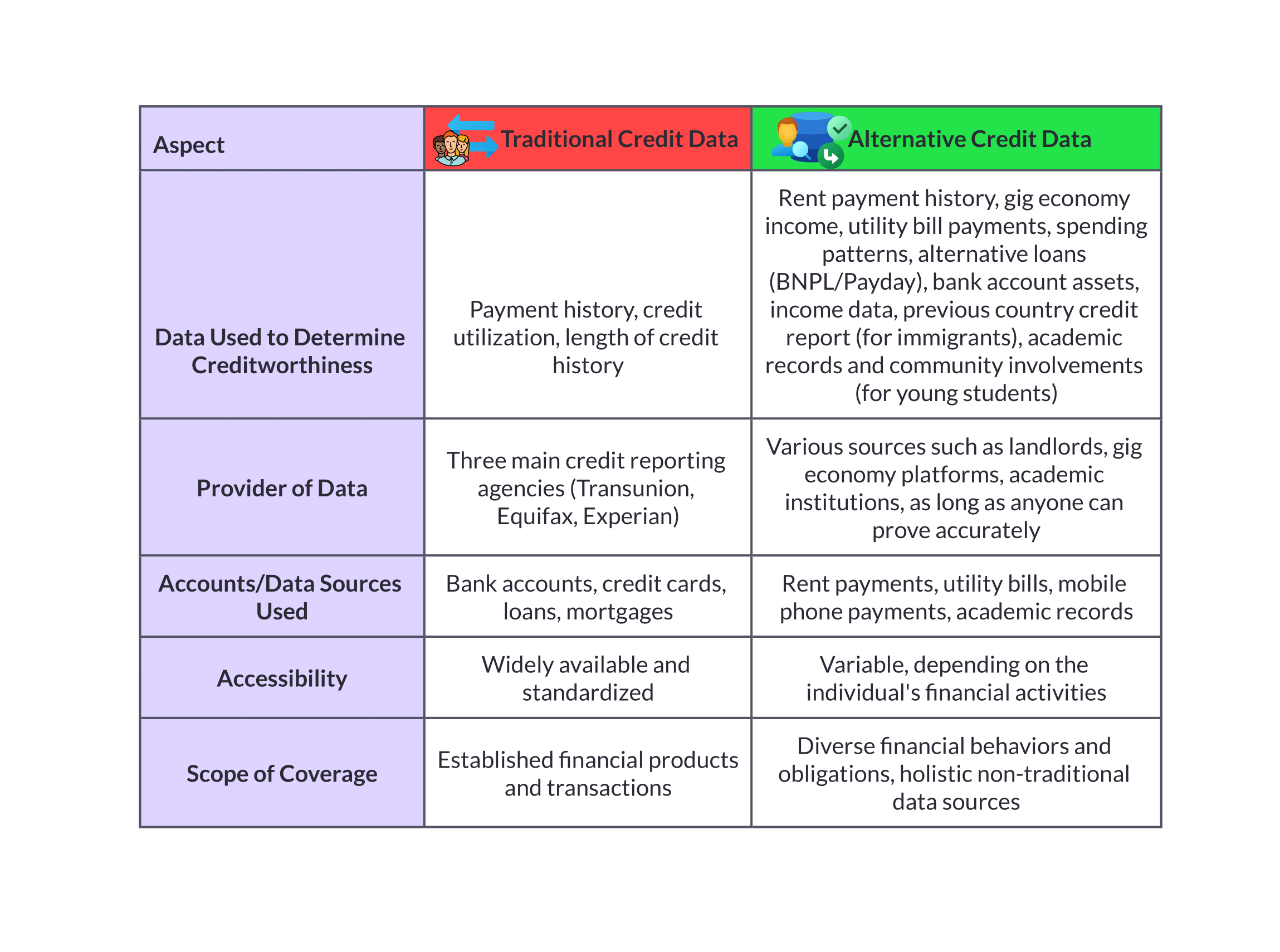

What’s Alternative Credit Data and how is it used?

Lenders can use alternative credit data, which is financial data that is typically disclosed to the three major credit reporting agencies (Transunion, Equifax, and Experian), to help them decide whether to provide credit or make an offer of a loan. Lenders mostly use information from these agencies—which is provided in an easy-to-read format, including a credit report and score—for the majority of loan applications.

Alternative data includes non-credit obligations such as monthly rent payment history, utilities bill payments, insurance, childcare payments, gig economy income, and more. AxcessAlternativeData’s unique and proprietary credit modeling algorithms incorporate all non-traditional data points and present alternative credit scores. This credit score, compared to those with traditional credit scores, can increase the loan approval rates, access higher credit, and more. Because traditional credit reports fail to paint the full picture of borrower’s, alternative credit scores can help establish, build, and improve credit scores and strengthen the financial creditworthiness.

For instance, a lender might initially lean towards rejecting an applicant solely based on a credit score of 600. Nevertheless, the inclusion of evidence regarding income sources and a prolonged track record of timely rental payments—both indicative of repayment reliability—could potentially sway the decision in favor of the borrower.

Alternative data becomes particularly relevant for individuals classified as credit invisibles, referring to those who lack a documented credit history or credit score. In such cases, alternative data may serve as the sole avenue for these individuals to secure loan access.

But who provide Alternative Credit Scores?

Incorporating alternative data into their decision-making process involves two key steps for lenders: acquiring the data and integrating it into their loan approval procedures. For the former, lenders may request applicants to manually submit documents such as bank statements and pay stubs, or utilize Plaid’s lending products to swiftly access this information. This is very time consuming for lenders.

Now, with AxcessAltData, lenders can swiftly obtain comprehensive reports akin to traditional credit scores within moments. These scores can then be utilized according to the lender’s discretion, adjusting their weight based on their risk tolerance.

Furthermore, lenders have the flexibility to determine the significance they attribute to alternative credit data compared to traditional credit reports—or even opt to solely rely on alternative data.