What’s Credit Report? A Comprehensive Guide to know everything about it.

1. What is a Credit Report?

A credit report is a comprehensive document that provides a detailed overview of an individual’s financial history,specifically their borrowing and repayment behavior. It serves as a financial snapshot, helping lenders assess a person’s creditworthiness before extending loans or credit.

Key Components of a Credit Report

A typical credit report includes the following essential elements:

- Personal Information: This section contains basic details such as the individual’s name, address, date of birth,and Social Security number.

- Credit Accounts: This lists all the credit accounts associated with the individual, including:

- Credit Cards: Details about credit card accounts, such as issuer, balance, credit limit, and payment history.

- Loans: Information on loans, including type (e.g., mortgage, auto loan, student loan), lender, amount, and repayment status.

- Other Credit: Records of other credit lines, such as department store cards or installment loans.

- Payment History: This section reflects the individual’s payment history on all credit accounts, typically showing whether payments were made on time, late, or missed.

- Inquiries: This component lists recent credit inquiries, which occur when a lender checks an individual’s credit report to assess their creditworthiness.

- Public Records: This may include information about bankruptcies, foreclosures, tax liens, or judgments against the individual.

- Credit Scores: While not always included directly on the report, credit scores are often calculated based on the information in the credit report.

Example of a credit account:

- Issuer: American Express

- Type: Credit Card

- Balance: $2,500

- Credit Limit: $10,000

- Payment History: On time for the past 12 months

Example of a public record:

- Type: Bankruptcy

- Date: 2018

- Chapter: 7

Understanding these key components is crucial for individuals and businesses alike, as they can significantly impact financial decisions and opportunities.

Importance of Credit Reports for Consumers and Businesses

Credit reports play a pivotal role in various aspects of financial life. For consumers, they can:

- Determine Loan Eligibility: Lenders often use credit reports to assess an individual’s creditworthiness and determine whether to approve loans or credit cards. A good credit report can lead to better interest rates and terms.

- Influence Insurance Premiums: In some cases, insurance companies use credit reports to determine insurance premiums, particularly for auto and homeowners insurance. A good credit score can result in lower premiums.

- Impact Job Applications: While not as common as in the past, some employers may still consider credit reports as part of the hiring process, especially for positions that involve handling finances.

- Help Identify Fraud: Monitoring credit reports can help individuals detect signs of identity theft or fraudulent activity.

For businesses, credit reports are essential for:

- Evaluating Business Creditworthiness: Lenders use credit reports to assess a business’s financial health and determine its eligibility for loans or lines of credit.

- Managing Risk: Businesses can use credit reports to evaluate the creditworthiness of customers and suppliers,helping to mitigate risks associated with unpaid invoices or defaulting customers.

- Making Informed Hiring Decisions: In certain industries, businesses may use credit reports to assess the financial responsibility of potential employees, especially those in positions that involve handling finances.

2. Overview of Credit Reporting Agencies (CRAs)

Credit reporting agencies (CRAs) play a crucial role in the credit reporting system. They collect, compile, and maintain credit information on individuals and businesses, which is then used by lenders, insurers, and other authorized parties to assess creditworthiness.

The three major CRAs in the United States are:

Experian

- Founded: 1841

- Services: Credit reports, analytics, identity theft protection, and fraud prevention.

- Global Presence: Operates in over 37 countries.

- Unique Features: Offers a variety of credit monitoring and identity theft protection services, including Experian IdentityWorks.

Equifax

- Founded: 1899

- Services: Credit reports, risk management, analytics, and data-driven marketing solutions.

- Global Presence: Operates in over 20 countries.

- Unique Features: Offers a range of credit monitoring and fraud prevention services, including Equifax IdentityWorks.

TransUnion

- Founded: 1968

- Services: Credit reports, risk management, marketing services, and identity management solutions.

- Global Presence: Operates in over 30 countries.

- Unique Features: Offers a variety of credit monitoring and identity theft protection services, including TransUnion TrueIdentity.

Key differences between the three CRAs:

- Data Collection: Each CRA collects data from different sources, which can lead to slight variations in the information reported.

- Scoring Models: The credit scoring models used by each CRA may differ slightly, resulting in variations in credit scores.

- Additional Services: Each CRA offers a range of additional services, such as credit monitoring, identity theft protection, and fraud alerts.

It’s important to note that while these three CRAs are the largest in the United States, there are also smaller regional CRAs that may report credit information to lenders in specific areas.

Factors that can affect credit reporting:

- Late Payments: Missed or late payments can have a significant negative impact on credit scores.

- High Credit Utilization: Using a large portion of available credit can also lower credit scores.

- Public Records: Bankruptcies, foreclosures, and judgments can have a severe negative impact on credit scores.

- Inquiries: Too many credit inquiries within a short period can lower credit scores.

Understanding the role of credit reporting agencies and the factors that can affect credit scores is essential for individuals and businesses looking to manage their financial health effectively.

3. History of Credit Reporting

Early Forms of Credit Reporting (Origins in the 19th Century)

The concept of credit reporting can be traced back to the 19th century, when merchants and shopkeepers began keeping records of customers’ payment histories. These early forms of credit reporting were primarily informal and localized, relying on word-of-mouth and personal relationships.

One notable early development was the establishment of credit agencies, which collected and disseminated information about individuals’ creditworthiness. These agencies were often formed by groups of merchants or retailers who wanted to share information to reduce the risk of bad debts.

Evolution of Credit Bureaus in the 20th Century

In the 20th century, credit bureaus emerged as more formal and organized entities. These bureaus began to collect and store credit information on a larger scale, using standardized reporting formats and processes. As the economy grew and credit markets expanded, the demand for reliable credit information increased, driving the growth and development of credit bureaus.

During this period, credit bureaus faced challenges in maintaining data accuracy and protecting consumer privacy. As the volume of information they handled grew, the risk of errors and unauthorized access also increased. To address these concerns, industry standards and regulations were developed to ensure the integrity and security of credit reporting data.

Key Legislative Milestones (e.g., Fair Credit Reporting Act)

Several key legislative milestones have shaped the credit reporting industry. One of the most significant pieces of legislation is the Fair Credit Reporting Act (FCRA), enacted in 1970. The FCRA established consumer rights with respect to credit reports, including the right to access their reports, dispute inaccurate information, and place a fraud alert on their files.

Other important legislative developments include:

- Privacy Act of 1974: This law established guidelines for federal agencies to collect, maintain, and use personal information, including credit data.

- Truth in Lending Act: This act requires lenders to disclose the terms and conditions of loans, including interest rates, fees, and repayment schedules.

- Fair Debt Collection Practices Act: This act prohibits debt collectors from using abusive, unfair, or deceptive practices when attempting to collect debts.

Emergence of Modern Credit Scoring Systems (e.g., FICO)

In the late 20th century, the development of modern credit scoring systems revolutionized the credit reporting industry. These systems use statistical models to evaluate creditworthiness based on a variety of factors, including payment history, credit utilization, length of credit history, types of credit, and public records.

One of the most widely used credit scoring models is the FICO score, developed by Fair Isaac Corporation. FICO scores range from 300 to 850, with higher scores indicating better creditworthiness. Lenders often use FICO scores to assess loan risk and determine interest rates.

The development of credit scoring systems has made it easier for lenders to evaluate credit risk and make more informed lending decisions. However, it has also raised concerns about the potential for bias and discrimination in credit scoring, as certain factors may disproportionately affect certain groups of people.

Personal Information: What Is Included and Why It Matters

The personal information section of a credit report provides basic details about the individual, including:

- Name: Full legal name

- Address: Current and previous addresses

- Date of birth: Birthdate

- Social Security number: A unique identifier used to track credit activity

This information is essential for verifying the individual’s identity and ensuring that the credit report belongs to the correct person. It also helps to prevent identity theft and fraud.

Credit Accounts: Types (Credit Cards, Loans, Mortgages)

The credit accounts section of a credit report lists all the credit accounts associated with the individual. This includes:

- Credit Cards: Information about credit card accounts, such as issuer, balance, credit limit, and payment history.

- Loans: Details on loans, including type (e.g., mortgage, auto loan, student loan), lender, amount, and repayment status.

- Other Credit: Records of other credit lines, such as department store cards or installment loans.

The credit accounts section provides a comprehensive overview of the individual’s borrowing history and demonstrates their ability to manage debt responsibly.

Public Records: Bankruptcies, Liens, and Civil Judgments

The public records section of a credit report lists any negative public records associated with the individual. This includes:

- Bankruptcies: Information about bankruptcy filings, including the type of bankruptcy (e.g., Chapter 7, Chapter 13) and the date of filing.

- Liens: Details on liens placed against the individual’s property, such as tax liens or judgments.

- Civil Judgments: Information about civil judgments against the individual, such as lawsuits or unpaid debts.

Public records can have a significant negative impact on credit scores and can make it difficult to obtain new credit. It’s important to address any public records promptly and take steps to improve creditworthiness.

Inquiries: Soft vs. Hard Inquiries and Their Impacts

The inquiries section of a credit report lists recent credit inquiries, which occur when a lender checks an individual’s credit report to assess their creditworthiness. There are two types of inquiries:

- Soft inquiries: These inquiries are made by companies that are considering extending credit to the individual,but do not have a significant impact on credit scores. Examples of soft inquiries include pre-approved credit card offers or when a potential employer checks an individual’s credit report as part of the hiring process.

- Hard inquiries: These inquiries are made by lenders who are considering extending credit to the individual.Hard inquiries can have a minor negative impact on credit scores, especially if multiple hard inquiries are made within a short period of time.

It’s important to be mindful of the number of hard inquiries on your credit report, as too many can indicate that you may be shopping for credit, which can be a red flag for lenders.

Credit Score: Calculation Factors and Its Relationship with Credit Reports

A credit score is a numerical representation of an individual’s creditworthiness. It is calculated based on the information contained in credit reports. While credit scores are not included directly on credit reports, they are often derived from the data within the report.

Several factors are considered when calculating a credit score, including:

- Payment history: This is the most significant factor and accounts for approximately 35% of the credit score. A history of on-time payments is essential for a good credit score.

- Credit utilization: This refers to the amount of credit that is being used compared to the total credit available. High credit utilization can negatively impact credit scores.

- Length of credit history: The longer the credit history, the better. This factor accounts for approximately 15% of the credit score.

- Types of credit: Having a mix of different types of credit, such as credit cards, loans, and mortgages, can positively impact credit scores.

- New credit: Frequent applications for new credit can negatively impact credit scores.

The specific factors and weights used in credit scoring models may vary slightly between different agencies, but these five factors are generally considered to be the most important.

Relationship between credit scores and credit reports

Credit reports provide the raw data used to calculate credit scores. The information contained in credit reports, such as payment history, credit utilization, and public records, is analyzed by credit scoring models to generate a credit score.

A good credit score can have many benefits, including:

- Lower interest rates: Individuals with good credit scores are typically offered lower interest rates on loans and credit cards.

- Improved loan approval odds: Lenders are more likely to approve loan applications for individuals with good credit scores.

- Better rental prospects: Some landlords may consider credit scores when evaluating potential tenants.

- Lower insurance premiums: In some cases, insurance companies may offer lower premiums to individuals with good credit scores.

It’s important to note that credit scores are not static and can change over time. By understanding the factors that influence credit scores and taking steps to improve creditworthiness, individuals can enhance their financial prospects.

4. The Role of Credit Reporting Agencies (CRAs)

The Big Three: Experian, Equifax, and TransUnion

As previously mentioned, the three major credit reporting agencies (CRAs) in the United States are Experian, Equifax,and TransUnion. These companies collect, compile, and maintain credit information on individuals and businesses,which is then used by lenders, insurers, and other authorized parties to assess creditworthiness.

Each CRA maintains its own database of credit information, which can lead to slight variations in the data reported by each agency. It’s generally recommended to check your credit report from all three CRAs annually to ensure accuracy and identify any discrepancies.

How CRAs Collect and Report Data

CRAs collect credit information from a variety of sources, including:

- Lenders: Banks, credit unions, credit card companies, and other lenders report information about loans and credit accounts to CRAs.

- Public records: Government agencies, such as courts and tax authorities, report public records, such as bankruptcies, liens, and judgments, to CRAs.

- Other businesses: Retailers, utility companies, and other businesses may report information about payment history to CRAs.

CRAs use this information to create credit reports, which are then provided to authorized parties upon request.

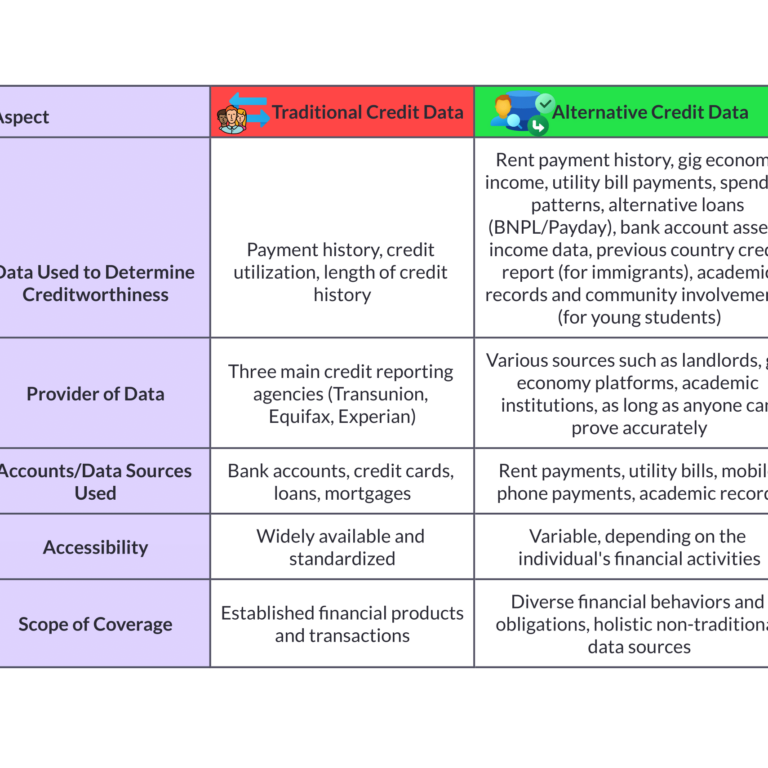

Alternative Credit Reporting Agencies and Their Role

In addition to the three major CRAs, there are also alternative credit reporting agencies that collect and report credit information. These agencies may specialize in reporting data on individuals with limited or no credit history, such as those who are new to credit or have been unable to establish a traditional credit history.

Alternative credit reporting agencies can be helpful for individuals who have difficulty obtaining credit through traditional channels. By providing lenders with additional information about their creditworthiness, these agencies can help individuals build a credit history and access credit opportunities.

Consumer Protections and Rights Under the FCRA

The Fair Credit Reporting Act (FCRA) provides consumers with important rights and protections related to credit reports. These include:

- Access to credit reports: Consumers have the right to obtain a copy of their credit report from each of the three major CRAs once a year for free.

- Dispute inaccurate information: Consumers can dispute any inaccurate information on their credit reports. If a dispute is found to be valid, the CRA must investigate and correct the error.

- Place a fraud alert: Consumers can place a fraud alert on their credit reports if they believe they are a victim of identity theft. A fraud alert can help prevent unauthorized credit activity.

- Opt out of pre-approved credit offers: Consumers can opt out of receiving pre-approved credit offers from most lenders.

Understanding your rights under the FCRA is essential for protecting your credit and ensuring that your credit reports are accurate and complete

5. How Credit Reports Impact Consumers

The Role of Credit Reports in Loan Approvals

Credit reports are a cornerstone of the lending process. Lenders use credit reports to assess an individual’s creditworthiness and determine whether to approve loans or credit cards. A good credit report can lead to better interest rates, lower down payments, and more favorable loan terms. Conversely, a poor credit report can make it difficult to obtain credit or result in higher interest rates and fees.

Impact on Interest Rates, Insurance, and Employment

Credit reports can also influence other aspects of financial life, including:

- Interest rates: Individuals with good credit scores are typically offered lower interest rates on loans and credit cards. This can result in significant savings over the life of a loan.

- Insurance premiums: In some cases, insurance companies may use credit reports to determine insurance premiums, particularly for auto and homeowners insurance. A good credit score can result in lower premiums.

- Employment: While not as common as in the past, some employers may still consider credit reports as part of the hiring process, especially for positions that involve handling finances.

How to Obtain and Review Your Credit Report

Under the Fair Credit Reporting Act (FCRA), consumers have the right to obtain a free copy of their credit report from each of the three major credit reporting agencies (Experian, Equifax, and TransUnion) once a year. You can obtain your credit report online at AnnualCreditReport.com or by calling 1-877-322-8228.

When reviewing your credit report, be sure to check for errors, inconsistencies, or unauthorized accounts. If you find any problems, dispute them with the credit reporting agency.

Common Errors in Credit Reports and How to Dispute Them

Errors can occur in credit reports for various reasons, including data entry mistakes, identity theft, or incorrect reporting by creditors. Common errors include:

- Incorrect personal information: Verify that your name, address, and Social Security number are correct.

- Incorrect payment history: Check that your payment history is accurate and up-to-date.

- Unauthorized accounts: Look for any accounts that you do not recognize or that were opened without your authorization.

- Negative public records: Verify that any negative public records, such as bankruptcies or liens, are accurate and have been resolved.

If you find an error in your credit report, dispute it with the credit reporting agency in writing. The CRA is required to investigate the dispute and correct any errors.

Impact of Identity Theft and Fraud on Credit Reports

Identity theft can have a devastating impact on credit reports. When a thief uses your personal information to open new accounts or make fraudulent purchases, it can damage your credit score and make it difficult to obtain credit.

If you believe you are a victim of identity theft, take immediate action to protect your credit. This includes placing a fraud alert on your credit reports, closing any accounts that have been compromised, and filing a police report.

6. How Credit Reports Impact Businesses

Importance for Lenders in Assessing Borrower Risk

Credit reports play a crucial role in the lending process for businesses. Lenders use credit reports to assess a borrower’s financial health and determine their ability to repay loans. A good credit report can help businesses obtain loans with favorable terms, while a poor credit report may make it difficult to secure financing.

Use by Employers in Hiring Decisions

While less common than in the past, some employers may still consider credit reports as part of the hiring process,especially for positions that involve handling finances. However, the use of credit reports in hiring decisions is subject to increasing scrutiny, and many states have enacted laws that restrict the use of credit information in employment decisions.

Role in B2B Transactions and Credit Extensions

Credit reports are also important in business-to-business (B2B) transactions. Businesses often extend credit to customers, and credit reports can help assess the creditworthiness of these customers. A good credit report can provide reassurance that a customer is likely to pay their invoices on time, while a poor credit report may indicate a higher risk of non-payment.

Legal Obligations of Businesses When Using Credit Reports (FCRA Compliance)

Businesses that use credit reports have legal obligations under the Fair Credit Reporting Act (FCRA). These obligations include:

- Providing notice: Businesses must provide notice to consumers before obtaining their credit reports.

- Obtaining consent: Businesses must obtain the consumer’s consent before using credit reports for employment decisions, unless they have a legitimate business need for the information.

- Correcting errors: Businesses must investigate and correct any errors in credit reports that they obtain.

- Disclosing adverse actions: If a business takes an adverse action against a consumer based on their credit report,they must provide the consumer with notice and information about their rights under the FCRA.

By understanding and complying with the FCRA, businesses can protect themselves from legal liability and maintain positive relationships with their customer

7. Modern Credit Scoring Models

FICO Scores: Breakdown of the Model

The FICO score is one of the most widely used credit scoring models in the United States. It is calculated based on five key factors:

- Payment history: This is the most important factor, accounting for 35% of the FICO score. It reflects the individual’s history of making on-time payments on credit accounts.

- Credit utilization: This measures the amount of credit that is being used compared to the total credit available. A high credit utilization ratio can negatively impact the FICO score.

- Length of credit history: The longer the credit history, the better. This factor accounts for 15% of the FICO score.

- Types of credit: Having a mix of different types of credit, such as credit cards, loans, and mortgages, can positively impact the FICO score.

- New credit: Frequent applications for new credit can negatively impact the FICO score.

FICO scores range from 300 to 850, with higher scores indicating better creditworthiness. Lenders often use FICO scores to assess loan risk and determine interest rates.

VantageScore: How It Differs from FICO

VantageScore is another popular credit scoring model that differs from FICO in several ways:

- Scoring range: VantageScore ranges from 501 to 850, making it easier to compare scores across different models.

- Factors considered: VantageScore considers a broader range of factors than FICO, including medical bills and rent payments.

- Weighting: VantageScore places more emphasis on recent payment history than FICO.

While both FICO and VantageScore are widely used, lenders may use different models or a combination of models to assess creditworthiness.

Use of Alternative Data (e.g., Utility Bills, Rent Payments)

In recent years, there has been a growing trend toward the use of alternative data in credit scoring. Alternative data refers to information that is not typically included in traditional credit reports, such as utility bills, rent payments, and online purchase history.

Alternative data can be particularly helpful for individuals who have limited or no credit history. By providing lenders with additional information about their financial behavior, alternative data can help these individuals build credit and access credit opportunities.

The Role of Artificial Intelligence and Machine Learning in Credit Scoring

Artificial intelligence (AI) and machine learning are increasingly being used to develop more sophisticated credit scoring models. These technologies can analyze large datasets of credit information to identify patterns and trends that may not be apparent to human analysts.

AI and machine learning can also help to reduce bias in credit scoring by identifying and mitigating factors that may disproportionately affect certain groups of people. By using more objective and data-driven approaches, AI and machine learning can help to create a more equitable credit scoring system.

8. Global Credit Reporting Practices

Credit Reporting Systems in Major Economies

United States: The U.S. credit reporting system is dominated by the three major credit reporting agencies (Experian,Equifax, and TransUnion). Credit reports are widely used by lenders, insurers, and employers to assess creditworthiness.

United Kingdom: The UK credit reporting system is similar to the U.S. system, with three major credit reporting agencies (Experian, Equifax, and Callcredit). However, the UK has stricter data protection laws, which limit the amount of information that can be included in credit reports.

European Union: The EU has a patchwork of credit reporting systems, with each member state having its own unique approach. Some countries have centralized credit bureaus, while others have more decentralized systems. The EU has also enacted regulations to protect consumer privacy and ensure the fair use of credit information.

China: China’s credit reporting system is still developing, but it is becoming increasingly sophisticated. The People’s Bank of China has established a national credit reporting system that collects and reports information on individuals and businesses.

Emerging Markets and Their Approach to Credit Reporting

Emerging markets are facing increasing challenges in developing effective credit reporting systems. These challenges include:

- Limited data availability: In many emerging markets, there is limited data available on individuals and businesses, making it difficult to assess creditworthiness.

- Lack of infrastructure: Developing countries may lack the infrastructure necessary to collect, store, and analyze credit data.

- Regulatory challenges: Establishing and enforcing credit reporting regulations can be difficult in emerging markets.

Despite these challenges, many emerging markets are making progress in developing credit reporting systems. This is being driven by the growing need for credit to finance economic growth and development.

Cross-Border Credit Reporting Challenges

Cross-border credit reporting can be challenging due to differences in data privacy laws, reporting standards, and cultural norms. Businesses that operate in multiple countries may need to comply with different credit reporting regulations and standards.

One of the major challenges in cross-border credit reporting is the lack of standardized data formats. This can make it difficult to compare credit information from different countries. Additionally, differences in data privacy laws can limit the amount of information that can be shared across borders.

To address these challenges, international organizations and industry groups are working to develop standardized credit reporting practices and frameworks. These efforts aim to facilitate cross-border credit reporting and promote financial inclusion.

10. The Future of Credit Reporting

Trends in Credit Data Collection and Usage (e.g., Social Media, Behavioral Data)

The credit reporting industry is constantly evolving, and new technologies and data sources are emerging. One trend is the increasing use of social media and behavioral data to assess creditworthiness. This includes analyzing individuals’ online activity, social media interactions, and purchasing behavior to gain insights into their financial habits.

While the use of alternative data sources can provide valuable information, it also raises concerns about privacy and the potential for bias. It is important to ensure that alternative data is used ethically and responsibly, and that it is not used to discriminate against individuals.

Real-Time Credit Reporting and Its Potential Impact

Real-time credit reporting refers to the ability to access and update credit information in real time, rather than relying on periodic reports. This technology has the potential to revolutionize the credit reporting industry by providing lenders with more up-to-date and accurate information.

Real-time credit reporting could also lead to more personalized and flexible credit products. For example, lenders could offer dynamic interest rates that adjust based on an individual’s real-time creditworthiness. However, real-time credit reporting also raises concerns about privacy and the potential for misuse of data.

Blockchain Technology and Decentralized Credit Reporting

Blockchain technology is another emerging trend in the credit reporting industry. Blockchain is a distributed ledger technology that can be used to securely store and share data. This could potentially be used to create decentralized credit reporting systems that are more transparent and resistant to fraud.

Decentralized credit reporting could give individuals more control over their credit data and reduce the risk of data breaches. However, it also presents challenges in terms of interoperability and scalability.

Legislative and Regulatory Changes Impacting Credit Reporting

The credit reporting industry is subject to ongoing legislative and regulatory changes. These changes can impact the way credit reports are collected, used, and protected.

Some potential legislative and regulatory changes that could affect the future of credit reporting include:

- Data privacy laws: Stricter data privacy laws could limit the amount of information that can be collected and used in credit reports.

- Anti-discrimination laws: Laws that prohibit discrimination in lending could require credit reporting agencies to take steps to mitigate bias in their models.

- Financial inclusion initiatives: Governments may implement policies to promote financial inclusion, which could include expanding access to credit for underserved populations.

The Rise of Alternative Credit Scoring Models for Financial Inclusion

Alternative credit scoring models are being developed to address the limitations of traditional credit scoring systems.These models may use alternative data sources, such as rent payments, utility bills, and online purchase history, to assess creditworthiness.

Alternative credit scoring models can be particularly helpful for individuals who have limited or no credit history, such as those who are new to credit or have been unable to establish a traditional credit history. By providing lenders with additional information about their financial behavior, alternative credit scoring models can help these individuals build credit and access credit opportunities.

The future of credit reporting is likely to be shaped by these trends and developments. As technology continues to advance and regulatory frameworks evolve, the credit reporting industry will need to adapt to meet the changing needs of consumers and businesses. In this space, AxcessRent, is playing a role to transform a alternative credit scoring model.

11. Practical Tips for Consumers

How to Improve and Maintain a Good Credit Score

- Pay bills on time: This is the most important factor in determining a credit score. Make sure to pay all bills on time, every month.

- Keep credit utilization low: Try to keep your credit card balances below 30% of your credit limit. High credit utilization can negatively impact your credit score.

- Lengthen credit history: The longer your credit history, the better. Avoid closing old credit accounts, as this can shorten your credit history.

- Limit new credit inquiries: Too many hard inquiries within a short period can lower your credit score. Only apply for new credit when necessary.

- Dispute errors: Regularly review your credit reports and dispute any errors you find. Incorrect information can damage your credit score.

Managing Debt to Avoid Negative Credit Impacts

- Create a budget: A budget can help you track your income and expenses and avoid overspending.

- Prioritize debt payments: Focus on paying down high-interest debt first.

- Consider debt consolidation: Debt consolidation can help you combine multiple debts into a single loan with a lower interest rate.

- Avoid debt settlement: Debt settlement can damage your credit score and may have legal consequences.

Regular Credit Monitoring and Fraud Alerts

- Monitor your credit reports: Check your credit reports from all three major credit reporting agencies (Experian, Equifax, and TransUnion) at least once a year.

- Place a fraud alert: If you suspect identity theft, place a fraud alert on your credit reports. This can help prevent unauthorized credit activity.

- Sign up for credit monitoring: Consider signing up for a credit monitoring service to receive alerts about changes to your credit report.

Credit Freeze: When and How to Use It

- Consider a credit freeze: A credit freeze can help protect your credit from unauthorized access. It prevents new credit accounts from being opened in your name.

- Place a credit freeze: To place a credit freeze, contact the three major credit reporting agencies. There may be a fee to place or lift a credit freeze.

- Lift the freeze temporarily: If you need to apply for credit, you can temporarily lift the credit freeze.

2. Practical Tips for Businesses

Best Practices for Accessing and Using Credit Reports

- Obtain proper authorization: Ensure that you have the necessary authorization from consumers before accessing their credit reports.

- Limit access to authorized personnel: Restrict access to credit reports to only those employees who need the information for their job duties.

- Train employees on proper use: Provide training to employees on how to properly access, use, and protect credit reports.

- Follow industry best practices: Adhere to industry best practices for credit reporting, such as the guidelines established by the Fair Credit Reporting Act (FCRA).

Complying with Regulatory Obligations (e.g., FCRA, GDPR)

- Understand applicable laws: Be aware of the specific laws and regulations that apply to your business,including the FCRA and the General Data Protection Regulation (GDPR) if you operate in the EU.

- Document your procedures: Develop and document your procedures for accessing, using, and protecting credit reports.

- Conduct regular audits: Conduct regular audits to ensure compliance with regulatory requirements.

- Provide notice to consumers: Provide clear notice to consumers before obtaining their credit reports.

Developing Risk Assessment Models Based on Credit Data

- Use a variety of data sources: Consider using a variety of data sources, including credit reports, financial statements, and other relevant information, to develop your risk assessment models.

- Validate your models: Validate your models using historical data to ensure that they are accurate and reliable.

- Continuously update your models: As the economy and credit markets change, it is important to update your risk assessment models to reflect current conditions.

Protecting Consumer Data and Ensuring Ethical Use of Credit Reports

- Implement security measures: Implement strong security measures to protect consumer data from unauthorized access and use.

- Limit data retention: Only retain credit data for as long as necessary.

- Avoid discriminatory practices: Ensure that your credit scoring models do not discriminate against any group of individuals.

- Consider the ethical implications: Be mindful of the ethical implications of using credit data, and avoid using it in ways that could harm consumers.

13. Conclusion

Summary of Key Takeaways on the Importance of Credit Reports

Credit reports are essential tools for individuals and businesses alike. They provide a comprehensive overview of financial history, influencing loan approvals, interest rates, insurance premiums, and even employment decisions. Understanding the components of a credit report, the factors that affect credit scores, and the rights and responsibilities of consumers and businesses is crucial for managing financial health effectively.

Future Outlook for Credit Reporting Systems

The credit reporting industry is constantly evolving, driven by technological advancements, regulatory changes, and changing consumer needs. We can expect to see continued growth in the use of alternative data, real-time credit reporting,and decentralized credit reporting systems. Additionally, efforts to improve data privacy, reduce bias in credit scoring, and promote financial inclusion will likely shape the future of credit reporting.

Final Thoughts on Empowering Consumers and Businesses Through Credit Awareness

Credit awareness is essential for empowering individuals and businesses to make informed financial decisions. By understanding the importance of credit reports, managing debt responsibly, and taking proactive steps to protect credit,consumers and businesses can improve their financial well-being.

It is also important for businesses to use credit information ethically and responsibly, complying with regulatory requirements and avoiding discriminatory practices. By promoting credit awareness and fostering a healthy credit reporting ecosystem, we can create a more equitable and prosperous financial landscape for all.